Prepare the current year-end balance sheet for Armani Company, an undertaking of utmost importance, sets the stage for this enthralling narrative. Embark on a journey of financial exploration as we delve into the intricacies of balance sheet preparation, uncovering the secrets to presenting a clear and accurate snapshot of the company’s financial health.

This comprehensive guide will equip you with the knowledge and skills necessary to navigate the complexities of year-end balance sheet preparation. From gathering data and organizing it into meaningful categories to valuing assets and recognizing liabilities, we will explore every step in meticulous detail.

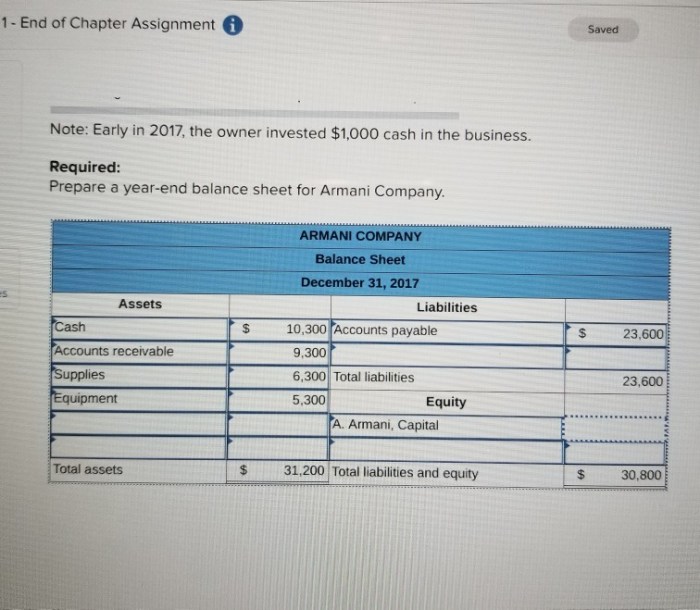

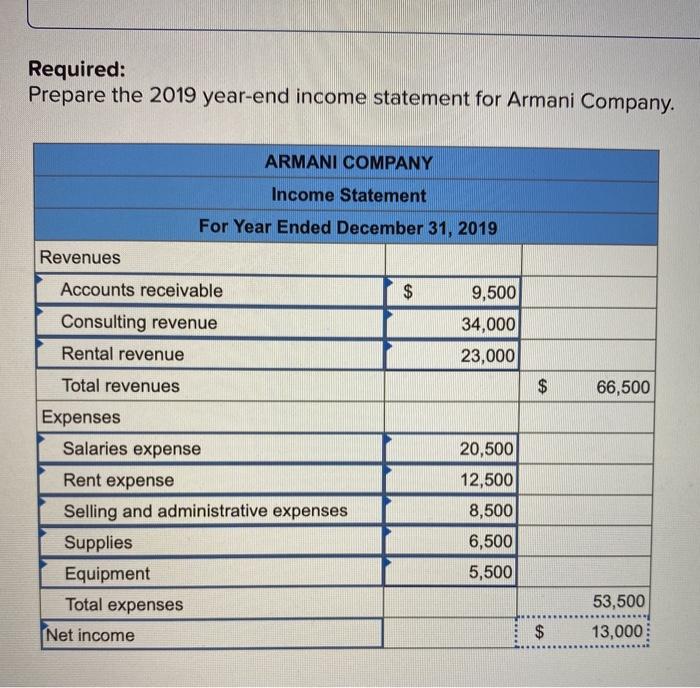

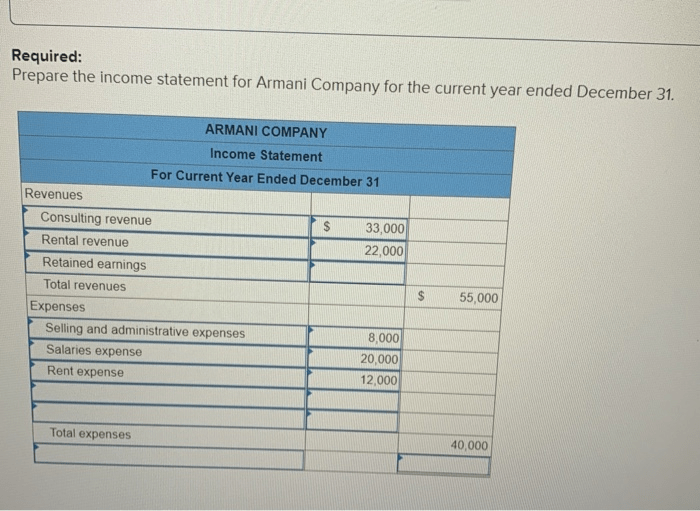

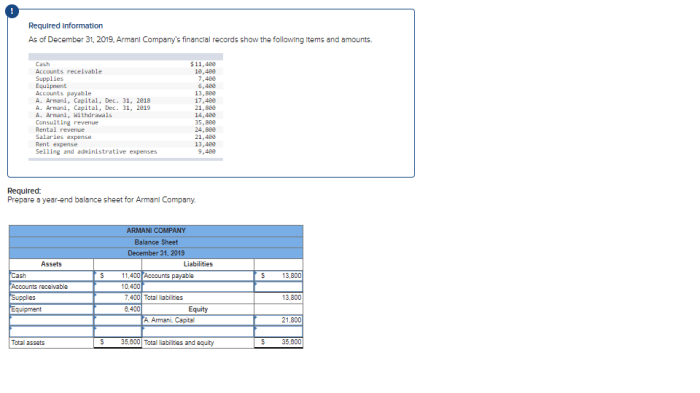

Financial Statement Preparation: Prepare The Current Year-end Balance Sheet For Armani Company

Preparing a year-end balance sheet is crucial for assessing a company’s financial position and performance at a specific point in time. It provides a comprehensive overview of the company’s assets, liabilities, and equity, offering insights into its financial health and stability.

Key Components of a Balance Sheet

- Assets:Economic resources owned or controlled by the company, such as cash, inventory, and fixed assets.

- Liabilities:Financial obligations owed by the company to others, such as accounts payable, loans, and taxes.

- Equity:The residual interest in the company’s assets after deducting liabilities, representing the owners’ claim to the business.

Data Gathering and Organization

Preparing a balance sheet requires gathering and organizing financial data from various sources, including:

- General ledger

- Sub-ledgers (e.g., accounts receivable, accounts payable)

- Bank statements

- Inventory records

The data should be categorized into relevant accounts (e.g., cash, inventory, accounts payable) to facilitate the preparation of the balance sheet.

Asset Valuation

Assets are valued using different methods depending on their nature:

- Cash:Face value

- Inventory:Cost or market value, whichever is lower (LCM)

- Fixed assets:Historical cost less accumulated depreciation

Asset valuation is critical as it directly impacts the company’s financial position and performance.

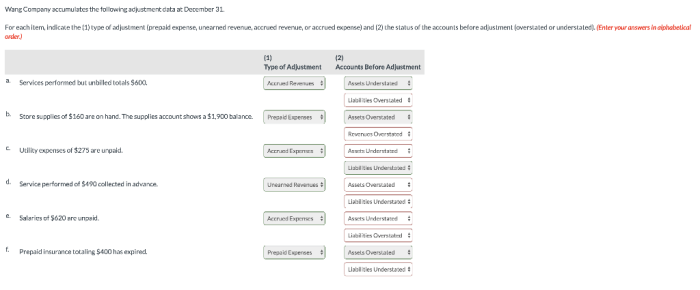

Liability Recognition

Liabilities are recognized when they meet the following criteria:

- There is a present obligation resulting from a past event.

- The obligation can be reliably measured.

- It is probable that the obligation will be settled through the outflow of resources.

Common types of liabilities include accounts payable, loans, and accrued expenses.

Equity Calculation

Equity is calculated using the following formula:

Equity = Assets

Liabilities

Equity represents the net worth of the company, indicating the owners’ residual claim to the business.

Balance Sheet Presentation, Prepare the current year-end balance sheet for armani company

The balance sheet is typically presented in a table format, with assets listed on the left side and liabilities and equity on the right side.

Proper formatting and alignment are essential for clarity and ease of understanding.

Review and Analysis

After preparing the balance sheet, it should be reviewed for accuracy and completeness. Financial ratios and metrics can be used to analyze the company’s financial health, such as:

- Current ratio

- Debt-to-equity ratio

- Return on equity

These ratios provide insights into the company’s liquidity, solvency, and profitability.

Essential FAQs

What is the purpose of a year-end balance sheet?

A year-end balance sheet provides a comprehensive snapshot of a company’s financial position at a specific point in time, typically the end of the fiscal year.

What are the key components of a balance sheet?

The balance sheet consists of three main components: assets, liabilities, and equity. Assets represent what the company owns, liabilities represent what the company owes, and equity represents the residual interest in the company.

How do you value different types of assets?

The valuation of assets depends on their nature. Common methods include historical cost, fair value, and discounted cash flow.